Failure to do so will result in the IRB taking legal action against the companys director. Kindly note that Minimum Fine of RM200 will be.

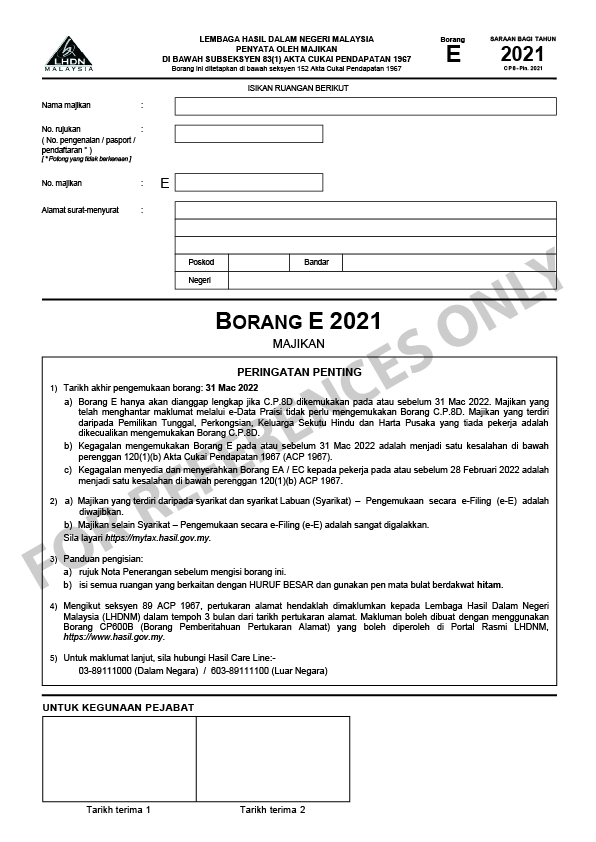

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

What is EA Form.

. In part f of form ea you can file for tax exemptions for certain. Sistem ezHASiL akan memaparkan skrin eBorang seperti di bawah. 30 4 tu kiranya hari terakhir kena hantar income.

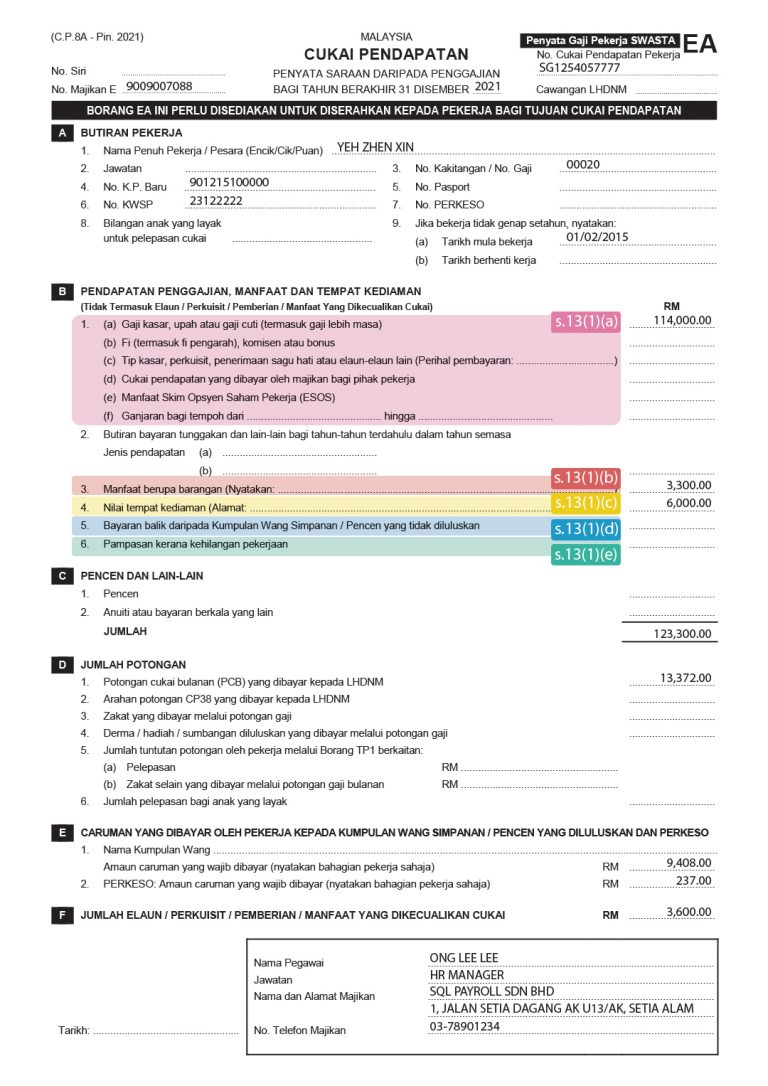

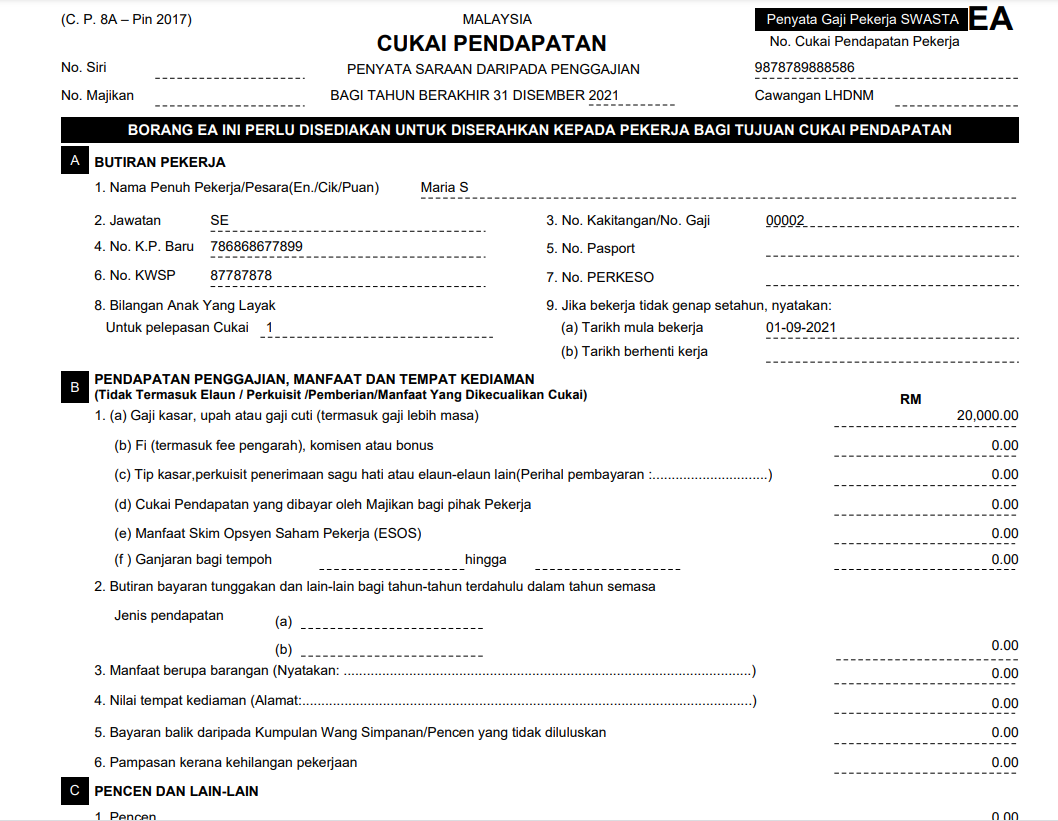

The Borang EA or the EA form is a yearly remuneration statement that every employee in the private sector will receive. A minimum fine of RM200 will be imposed by IRB for failure to prepare. Faizal Salleh Checklist Sebelum Masuk Bulan Cukai.

Talenox offers a convenient way for companies in Malaysia to import employee data store past years payroll records and generate tax forms such as. Cara Isi borang nyata cukai pendapatan Bila Tarikh buka Tarikh akhir e filing 2021 yang disediakan untuk efiling 2022 lhdn Lembaga Hasil Dalam Negeri. Borang E contains information.

Form E is an employee income declaration report that employers have to submit every year. The Borang E must be submitted by the 31st of march of every year. Before submitting you will.

Section 83 1A Income Tax Act 1967. What If You Fail To Submit Borang E and CP8D. Failure to prepare and render EA Form to employees before last day of February fine of RM.

Cara isi borang nyata cukai pendapatan bila tarikh buka. Januari 11 2022. Failure to do so will result in the IRB taking legal action against the companys director.

If youve done the above correctly you should have EAE form numbers correct. Filing Borang EA is easy when you have an LHDN-approved software like Talenox. Annual income statement prepared by company to employees for tax submission purpose.

English Version CP8D CP8D-Pin2021 Format. Submit Borang EA with Talenox at RM0. AskHelp Cara Submit Borang EA di LHDN Claim.

Employers have to prepare and distribute the EA Form before the last day of February every year. Posted February 19 2021 April 11 2022 admin. Tax season is here.

Once logged in head to Services e-Filing and select e-Form. How to use LHDN E-filing platform to file E form Borang E to LHDN ALL employers Sdn Bhd berhad sole proprietor partnership are mandatory to submit Employer Return Form. Under e-Form tab head to Non-Individual e-E section and select the correct Year of Assessment.

Now 2021 EA form number of this person should have the numbers that youre looking for. Feb 16 2021 1 MuslimProgrammer. Borang E 2021 PDF Reference Only.

Cara Submit Borang Cukai LHDN EA Form Drp Facebook. As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year. Start date Feb 16 2021.

LHDN kata kalau gaji setahun selepas tolak KWSP lebih RM34000 barulah kena daftar nombor cukai hantar borang cukai. Sekiranya pendapatan korang tak. Apply leave submit claim via mobile app easily save time and.

Kindly note that Fine of at least RM200 will be imposed. What If You Fail To Submit Borang E and CP8D. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran.

See how simple the process is. Failure in submitting Borang E will result in the IRB taking legal action against the companys directors. This employees statement of remuneration is also widely known as EA Form which shows the details of all employment income paid to each individual employee including the amount.

Pada skrin e-Borang pilih jenis borang dan klik tahun taksiran. In accordance with subsection 831A of the Income Tax Act 1967 ITA 1967 the Form CP8A CP8C must be prepared and rendered to the employees on or before end of. Its time to prepare Borang EA CP8A and Borang E CP8D for your employees.

E 2021 Explanatory Notes and EA EC Guide. Klik pautan e-Borang di bawah menu e-Filing.

How To Step By Step Income Tax E Filing Guide Imoney

Borang E Archives Tax Updates Budget Business News

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Ea Form 2021 2020 And E Form Cp8d Guide And Download

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

How To Prepare Ea Form Otosection

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

How To Step By Step Income Tax E Filing Guide Imoney

Malaysia Payroll Compliance How To Generate Ea Form In Deskera People

Lhdn Borang Ea Ea Form Malaysia Youtube

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection